Unlock the Secrets to Successful Commercial Real Estate Investing

Are you ready to venture into the world of commercial real estate investing and unlock the potential for extraordinary financial success? This comprehensive guide is your ultimate roadmap, providing you with the essential knowledge and strategies to navigate this rewarding yet complex market.

4.5 out of 5

| Language | : | English |

| File size | : | 2322 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| X-Ray | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 75 pages |

| Lending | : | Enabled |

Understanding Commercial Real Estate

Before diving into the specifics of investing, it's crucial to grasp the fundamentals of commercial real estate. This includes:

- Property Types: Explore the diverse range of commercial properties available, including office buildings, retail spaces, industrial warehouses, multi-family apartments, and healthcare facilities.

- Lease Structures: Understand the different types of lease agreements, such as single-tenant leases, multi-tenant leases, and ground leases, and their impact on your investment strategy.

- Zoning and Regulations: Familiarize yourself with local zoning laws and regulations that govern commercial property usage and development.

Due Diligence and Property Evaluation

Thorough due diligence is paramount in commercial real estate investing. To make informed decisions, conduct a comprehensive assessment of the property, including:

- Market Analysis: Examine the local market conditions, demand for commercial space, and competition.

- Property Inspection: Hire professional inspectors to evaluate the physical condition of the property, identify potential issues, and estimate repair costs.

- Tenant Profiles: Investigate the financial stability and business performance of existing tenants, as they significantly impact the value of the property.

Financing Strategies

Securing financing is essential in commercial real estate investing. Explore the various options available:

- Commercial Mortgages: Access traditional mortgages specifically designed for commercial properties, which may offer lower interest rates than residential mortgages.

- Private Lenders: Consider partnering with private lenders who may be more flexible with loan terms and requirements than banks.

- Equity Partners: Joint ventures with equity partners can provide additional capital and expertise to your investment.

Property Management and Operations

Once you acquire a commercial property, effective management is crucial for maximizing its value. Key considerations include:

- Tenant Relations: Maintain positive relationships with tenants, address their concerns promptly, and enforce lease agreements.

- Property Maintenance: Schedule regular inspections, plan proactive maintenance, and respond quickly to any emergencies.

- Expense Management: Monitor operating expenses closely, negotiate favorable vendor contracts, and implement cost-saving measures.

Investment Strategies and Exit Options

Develop a targeted investment strategy to align with your financial goals and risk tolerance:

- Income-Producing Properties: Acquire properties with strong cash flow and stable tenancies to generate regular income.

- Value-Add Properties: Identify properties with potential for improvement, increase their value through renovations or lease negotiations, and sell at a higher price.

- Development Projects: Engage in ground-up construction or redevelopment projects that offer the opportunity for significant returns, but also involve higher risks.

Plan your exit strategy in advance:

- Sale: Sell the property at a profit when the market conditions are favorable or when you have achieved your investment goals.

- 1031 Exchange: Defer capital gains taxes by exchanging the property for a like-kind property.

- Estate Planning: Incorporate your commercial real estate investments into your estate plan to ensure their smooth transfer and minimize tax liability.

<>

Embarking on a journey in commercial real estate investing requires a solid understanding of the market, due diligence, financing strategies, and property management. By mastering these principles and implementing them effectively, you can unlock the potential for financial success and build a solid portfolio of income-generating assets.

Remember, investing in commercial real estate is not without its risks, but with the right knowledge, preparation, and a strategic mindset, you can navigate the challenges and reap the rewards that this lucrative market has to offer.

4.5 out of 5

| Language | : | English |

| File size | : | 2322 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| X-Ray | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 75 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Maria T Codina Leik

Maria T Codina Leik Stephen Cheney

Stephen Cheney Giles Milton

Giles Milton Sarah Moore

Sarah Moore Larry Jacobson

Larry Jacobson Steve Miska

Steve Miska Sophie Lockwood

Sophie Lockwood Gene Kugach

Gene Kugach George Bird Grinnell

George Bird Grinnell Gervase Phinn

Gervase Phinn Roger Lajoie

Roger Lajoie Marla Cilley

Marla Cilley Gabe Montesanti

Gabe Montesanti Michelle Katz

Michelle Katz Prabhu Tl

Prabhu Tl Jeff Sadler

Jeff Sadler Gerry Virtue

Gerry Virtue Lenora Mattingly Weber

Lenora Mattingly Weber Gordon W Green

Gordon W Green Rick Griffin

Rick Griffin

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Enrique BlairAnd Other Conversations: The Last Interview Series - A Literary Masterpiece...

Enrique BlairAnd Other Conversations: The Last Interview Series - A Literary Masterpiece...

Mark MitchellJourney into the Uncharted Depths of Coruscant with "Deep Core: The Coruscant...

Mark MitchellJourney into the Uncharted Depths of Coruscant with "Deep Core: The Coruscant...

Fredrick CoxDiscover the Unforgettable Journey of Pakistani-American Identity in Willow...

Fredrick CoxDiscover the Unforgettable Journey of Pakistani-American Identity in Willow... Edgar Allan PoeFollow ·6.1k

Edgar Allan PoeFollow ·6.1k Earl WilliamsFollow ·13.3k

Earl WilliamsFollow ·13.3k Theo CoxFollow ·15.1k

Theo CoxFollow ·15.1k Fletcher MitchellFollow ·18.6k

Fletcher MitchellFollow ·18.6k Quincy WardFollow ·17.2k

Quincy WardFollow ·17.2k Graham BlairFollow ·12.1k

Graham BlairFollow ·12.1k Orson Scott CardFollow ·13.6k

Orson Scott CardFollow ·13.6k Adrien BlairFollow ·19.9k

Adrien BlairFollow ·19.9k

Brian West

Brian WestSmedley Butler: The Marines and the Making and Breaking...

: A Marine's...

Gabriel Garcia Marquez

Gabriel Garcia MarquezIschia, Capri, Sorrento, Positano, And Amalfi: An...

Explore the...

Felix Carter

Felix CarterAdorn Your Little Princess with Fleur Ange's Exquisite...

Welcome to the enchanting...

Kelly Blair

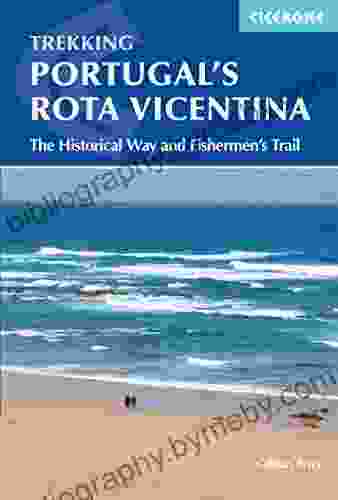

Kelly BlairUnveiling the Secrets of the Historical Way and Fishermen...

Step into the pages...

Angelo Ward

Angelo WardKnit the Cutest Thumbless Mittens for Your Little One:...

Prepare to be...

4.5 out of 5

| Language | : | English |

| File size | : | 2322 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| X-Ray | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 75 pages |

| Lending | : | Enabled |